City Council Highlights – May 2025

Adoption of FY 2025–26 budget in May, the City's revenue sources, fiscal responsibility

The City of Greenville’s fiscal year runs from July 1st through June 30th, and the adoption of the FY 2025-26 operating budget is anticipated in May. This is a very important annual review process that sets the City’s fiscal priorities and determines the operational budgets of various City departments and services.

City Council conducted Workshop Sessions on April 14th and April 28th to review and discuss the annual budget. As with all formal Council meetings and workshops, these budget discussions were open to the public.

City Council will hold a public hearing and the first reading of the FY 2025-26 operating budget on May 12th. The second reading and formal adoption of the FY 2025-26 budget will be held on May 19th.

City Council Member Dorothy Dowe, in her April DIALOGUE newsletter, provided an excellent overview of the City’s budget that highlights the budget process and sources of revenue, with specific discussion of the General Fund. The following is information from her newsletter.

In reviewing the City’s budget, it is helpful to understand the sources of revenue for the City, and how revenues are allocated to support Council priorities and City operations. The chart below shows the three main categories of revenues and examples of how they are used:

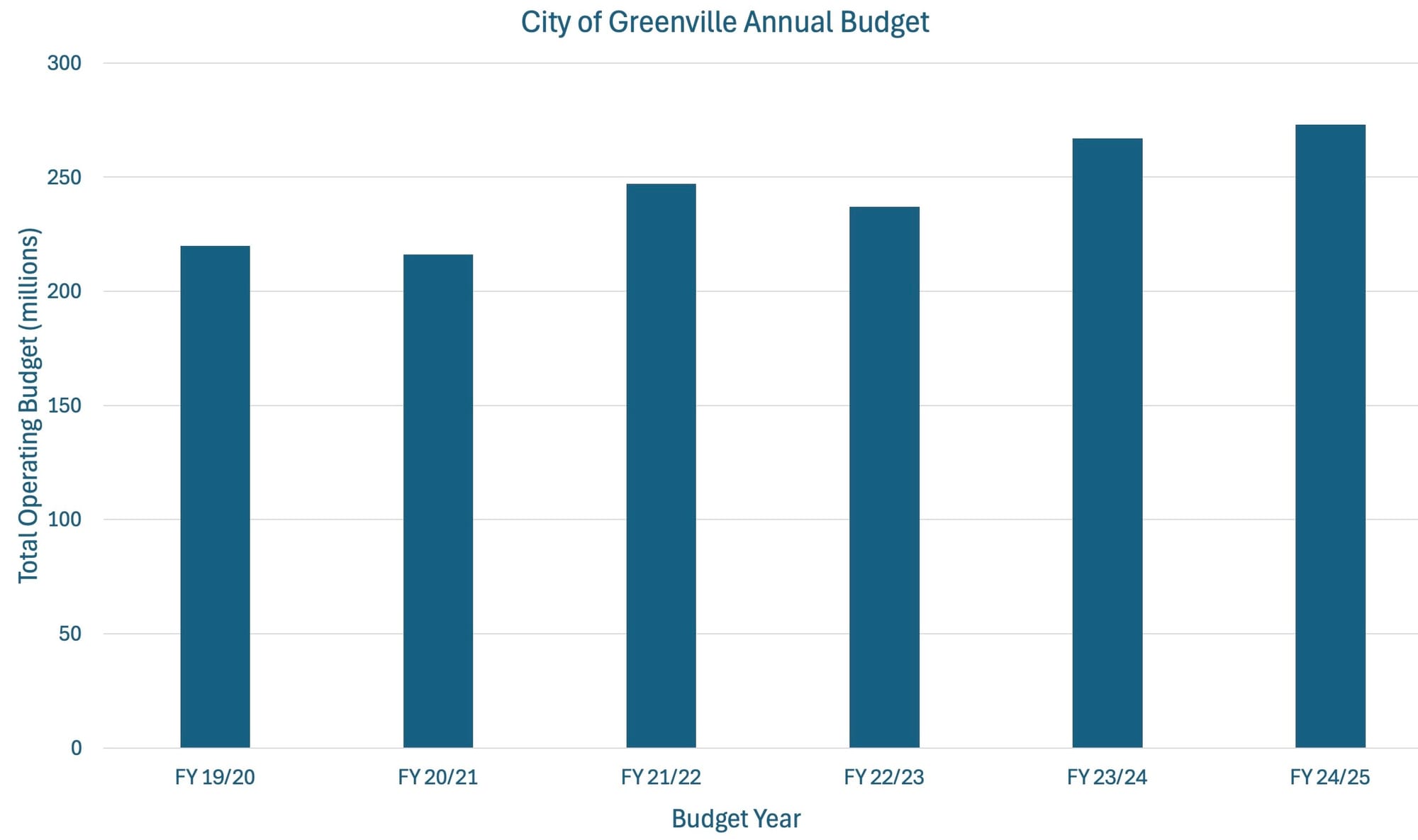

In fiscal years 2023-24 and 2024-25, the City’s annual budget has incrementally increased to just over $250 million. For comparison, the bar chart below depicts the City’s annual budgets for the last six fiscal years:

This incremental growth in the City’s expenditures has occurred while ensuring fiscal responsibility during a period of population growth and development. The General Fund is the City’s primary revenue source, typically representing over 65% of the total annual budget. Throughout this six year period, the City has operated with the same General Fund millage rate of 81.4 mills - a figure expected to remain unchanged in the coming fiscal year.

The millage rate is the tax rate approved by City Council that sets the portion of property taxes collected as revenues for the City’s General Fund. While holding this tax rate constant, the City of Greenville continues to be the only municipality in South Carolina to maintain an AAA bond rating from all three major credit rating agencies. These excellent ratings reflect the City’s consistent conservative budgeting process over the course of several years.

In the FY 2025-26 budget deliberations, City Council has focused on previously established city priorities, including:

- Public Safety & Engagement

- Mobility & Transportation

- Recreation, Open Space & Sustainability

- Neighborhoods & Affordable Housing

- Economic Development

Read more about the City’s annual budget and financial reports from the Office of Management & Budget: